YES BANK

YES BANK is one of the pioneer banks which started domestic money transfer under its flagship program YES Money. YES Money has developed a unique platform to meet the remittance need of migrants, unbanked and under-banked population in India. This product design brings technology to the end user through the Business Correspondent Agents and simultaneously ensures a technology oblivious experience for the end user. This cash to Bank A/c remittance service is offered across more than fifty thousand outlets pan India. YES BANK utilizes the Business Correspondent (BC) model to bring the transaction touch-point closer to this set of customers that is available even at non-banking hours. The money, received by the BC agent , is transfer processed by the Bank using National Electronic Fund Transfer (NEFT) and Immediate Payment service (IMPS) technology.

Through the Yes Banking Solution the following services are being offered:

- Money transfer facility up to 49999/-

- KYC senders can send up to 200000/- per month

- Transfer money to any bank in India

- Instant money transfer

- Immediate commission settlement

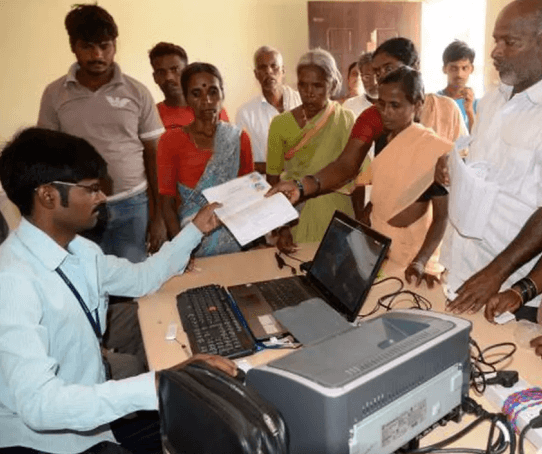

Bank CSP (Customer Service Point) Agents are those individuals who acts as an agent of the bank at places where it is not possible to open branch of the bank. The Kiosk Banking Business Correspondent (BC) model aims to provide real time, user friendly financial services to the consumers in their neighbourhood.

- Association with Banks like SBI / BOB / YES BANK

- Bank’s software / portal, User ID (KO ID) and Password

- Biometric Reader & software for electronic thumb impression

- Authorization Certificate of CSP by the BC

- Bank’s Banners, signage, Logo/Stickers/Leaflets/Contact Matrix

- Proper Training of CSP to operate the system by the BC

- Dedicated technical support from the local Supervisors of “VKV”

- Dedicated support from the Help Lines and web portal of “VKV”

- Web Software to operate different services (Recharge/Billing/Travel Solution)

- Opportunity to associate with SBI / BOB / Yes Bank

- Very easy to use application

- Hassle free and simple system

- Real time based transactions

- Very encouraging fee structure for generation of new revenue at CSP level

- Banking, Insurance, Pension and other financial products available for customers

- Opportunity to increase your earnings, goodwill & brand name in the market

- Office or Retail Outlet

- Furniture including chairs for customers

- Electricity

- Laptop or Desktop

- Internet Connectivity

- Printers: (a) General and (b) Thermal

- Web cam

- Finger Print Scanner

- Some Cash for availing Cash-Holding-Limit for successful transactions (at least Rs.25,000/-)

- Application form duly signed

- 10 Passport size colorful recent photos

- Educational Certificates Matric onwards

- PAN Card (Mandatory)

- AADHAAR Card (Mandatory)

- Voter I Card

- Driving License

- Shop Agreement

- Character / Police Verification Certificate

- Name, Address, Mobile No. and signature of two references

- Application Form, related documents and Registration fees received by “VKV” team

- Due Diligence Report (DDR) by the “VKV” team

- DDR to be filed to Bank’s local branch (Link / Base Branch

- Recommendation of Branch Manager to Regional / Circle Office.

- Recommendation of Regional Office to LHO

- Generation / creation of KO Code by the Bank

- Configuration of CSP Code by the “VKV” office

- Capturing of fingers of CSP Operator through Finger Print Scanner by the BC

- Terminal mapping & Activation of KO Code by the Bank

- Technical & theoretical Training of CSP by the “VKV” team

- Link Branch / Base Branch of the Bank is informed by the “VKV” team about activation of CSP

- CSP starts functioning